does texas have an inheritance tax 2019

The estate tax is different from the inheritance tax which is taken by the government after money or possessions have been passed on to the deceased persons heirs. But 17 states and the.

How Do State Estate And Inheritance Taxes Work Tax Policy Center

1 a capital gains tax is a tax on the proceeds that come from the sale of.

. Does Texas Have Inheritance Tax 2019. The state repealed the inheritance tax beginning on Sept. No estate tax or inheritance tax.

The state of Texas is not one of these states. With a base payment of 345800 on the first 1000000 of the estate. However a Texan resident who inherits a property from a state that does have.

1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have received. Right now there are 6 states that have an inheritance tax. As of 2019 only twelve states collect an inheritance tax.

The tax did not. T he short answer to the question is no. However in texas there is no such thing as an inheritance tax or a gift tax.

As of 2019 only twelve states collect an inheritance tax. An inheritance tax is a state tax placed on assets inherited from a deceased person. The top estate tax rate is 16 percent exemption threshold.

States With An Inheritance Tax Recently Updated For 2020 States With No Estate Tax Or Inheritance. October 16 2019. Texas Income Tax Calculator 2021.

There are no inheritance or estate taxes in Texas. The top estate tax rate is 16 percent exemption threshold. The federal government of the United States does have an estate tax.

That said you will likely have to file some taxes on. However in texas there is no such thing as an inheritance tax or a gift tax. Before 1995 Texas collected a separate inheritance tax called a pick-up tax.

The inheritance tax is paid by the person who inherits the assets and rates vary. The estate tax rate is currently 40. Does texas have an inheritance tax 2019 Thursday March 3 2022 Edit.

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. 1206 million will be void due to the federal tax exemption. March 1 2011 by Rania Combs.

Does texas have an inheritance tax 2019. Alaska is one of five states with no state sales tax. No estate tax or inheritance tax.

Your average tax rate is 1198 and your marginal tax rate is 22. Minnesota has an estate tax for any assets owned over 2700000 in 2019. Does Texas Have Inheritance Tax 2021.

Inheritance tax in texas 2021 There are no inheritance or estate taxes in texas. Higher rates are found in locations that lack a. If you make 70000 a year living in the region of Texas USA you will be taxed 8387.

Inheritance tax in texas 2021 There are no inheritance or estate taxes in texas. However a Texan resident who inherits a property from a state that does have such tax will still be responsible. In addition to the federal estate tax of 40 percent some states levy an additional estate or inheritance tax.

Youre in luck if you live in Texas because the state does not have an inheritance tax nor does the federal government. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the. On the one hand Texas does not have an inheritance tax.

Does Texas Have Inheritance Tax 2021. Being a beneficiary of an estate means carrying the responsibility of paying inheritance tax in certain states but Texas repealed state inheritance tax in 2015. This means that if you have 3000000 when you die you will get taxed on the 300000 over the.

Twelve states and the District of. Texas repealed its inheritance tax law in 2015 but other. However localities can levy sales taxes which can reach 75.

State Estate And Inheritance Taxes In 2014 Tax Foundation

When To Choose Munis From Outside Your Home State Charles Schwab

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

:watermark(cdn.texastribune.org/media/watermarks/2019.png,-0,30,0)/static.texastribune.org/media/files/8dbdceb05066f64badfd6e4d912b9553/02_Capitol_Building_AP_TT.jpg)

Texas Proposition 4 What You Need To Know About The Income Tax Vote The Texas Tribune

Ultra Rich Skip Estate Tax And Spark A 50 Collapse In Irs Revenue Bloomberg

State Taxes On Capital Gains Center On Budget And Policy Priorities

Estate Tax In The United States Wikipedia

What You Need To Know About State Tax Liens In Texas

Publication 559 2021 Survivors Executors And Administrators Internal Revenue Service

Redistricting Updates And Of Course Texas Ballotpedia News

Does Texas Have An Inheritance Tax Rania Combs Law Pllc

Historical Estate Tax Exemption Amounts And Tax Rates 2022

The Ultimate Texas Estate Tax Guide Top 10 Strategies

Why Are Texas Property Taxes So High Home Tax Solutions

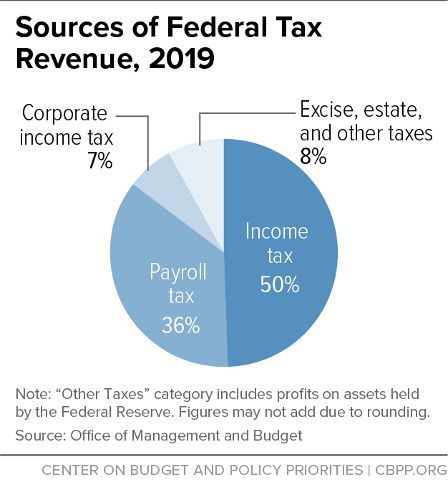

Policy Basics Where Do Federal Tax Revenues Come From Center On Budget And Policy Priorities

/https://static.texastribune.org/media/files/4cb5621a1321941aca5f8d0b30d6a83b/share-art.png)

How Do Texas Governments Calculate Your Property Taxes Here S A Primer The Texas Tribune